Financial markets analysis

Currency calendar

Economic data releases and MPC

meeting dates

Economic forecasts

21 November

2011

Business

Banking sales desk

(011)

535 4003

Corporate

sales desk

JHB

(011) 535 4002; DBN (031) 327 3000; CTN (021) 413 9300

Institutional

sales and marketing desk

(011)

535 4005

Derivative

sales and structuring

(011)

535 4021

Nedbank

Ian

Cruickshanks

(011) 295 8640

Tasnim Rawat

(011)

294 3744

Contents

Rand prospects: Possible Greek sovereign debt default

spreads contagion fears through European Union

Financial markets analysis: EU peripheral sovereign

debt collapse pushes fund flows to safe-havens

Currency calendar: Rand posts widespread depreciation

as risk appetite reverses

Economic data releases and MPC meeting dates

Nedbank

facts and forecasts

Rand

prospects:

In

last month’s Rand Prospects we highlighted how critical the next few months

would be for how the crisis in the Euro Zone evolves. We argued that markets would experience

significant volatility, as investors digested new economic news and assessed

the plans to resolve the European debt crisis.

The past month, but particularly the past few days, have been marred by

significant volatility with the rand falling by 5,4%, 2,9% and 5% against the

US dollar, euro and the British pound since mid-October.

This

is not surprising as the past month has yielded little in the form of decisive

action on the part of the policymakers to resolve the crisis. Most importantly, the European Central Bank

(ECB) is still unwilling to act as the lender of last resort by purchasing

sovereign bonds, in a move that now seems the only viable way to stop the

upward march of bond yields across the Euro Zone and calm global markets.

The

much anticipated G20 meeting in Cannes proved to be unexciting, with nothing

new being agreed to resolve the debt crisis.

The G20 concluded their meeting by welcoming the Euro Zone’s

“comprehensive plan” and urged “rapid elaboration and implementation, including

of country reforms.” The leaders

committed to ensuring that “the IMF continues to have resources to play its

systemic role”. Further details on

expanding the financial firepower of the IMF still need to be worked out, with

finance ministers expected to report back on their findings by early 2012.

While economic

policy has failed to deliver anything exciting, Europe’s political landscape

has experienced a shakeup. The

governments of both Italy and Greece have been removed, with the hope of

replacing them with more competent technocratic leadership that would help to

restore confidence in the two beleaguered countries.

Chart 1 : European bond yields continue to

rise |

|

|

|

Source: DataStream |

Silvio Berlusconi, the Italian

Prime Minister, resigned over the weekend.

Pressure has been building on his government to come up with a credible

solution to Italy’s debt burden – the second highest in Europe - as bond yields

shot to their highest level on record during the week. Berlusconi has been replaced by Mario Monti,

a former EU Commissioner and Professor of Economics. Although there have been calls for an early

election, it seems more likely that the authorities will focus on restoring

confidence with €200 billion of debt maturing by the end of next April. Earlier last week, the Greek parliament

elected Lucas Papademos, a former

vice-president of the European Central Bank, to head an interim government,

which must implement a new international bail-out and take the country to early

elections in February 2012.

The

reshuffling of European politicians (and the expanded European Financial

Stability Fund) will do little more than temporarily calm the markets. We have argued on numerous occasions that any

plan needs to have two components.

First, to ensure that Greece’s public finances are sustainable. The current proposal, where private investors

take a 50% haircut does not adequately address Greece’s insolvency, even with

these measures government debt to GDP will be around 120% of GDP by the end of

the decade. The second component is to

address liquidity concerns, which centre on fears that troubled governments may

not be able to roll over their debt. The

unwillingness of the European Central Bank (ECB) to act as lender of last

resort is a big stumbling block in any plans to address illiquidity within the

Euro Zone.

The European

debt crisis is not the only challenge global markets face. The currency wars appear to be

heating up, particularly between the US and China over the sustained

undervaluation of the renminbi, which is believed to give China an unfair

advantage in international trade. In a

move aimed squarely at China, the US Senate has recently passed a bill to penalise

countries that manipulate their exchange rates.

The IMF also recently entered the

fray. The Fund argued that the Chinese

financial system faced “a steady build up of vulnerabilities, particularly in

the property market, that require the government to relax its grip on banks,

the exchange rate and interest rates”.

The IMF said that one of the most important early reforms was to allow a

more flexible exchange rate.

With fiscal

sustainability under the spotlight globally, the local market got a sharp

reminder that a lapse in fiscal policy at home would have negative

consequences. Moody’s decision to change

South Africa’s outlook from “stable” to “negative” comes as a clear warning to

the authorities that they cannot rest on the laurels of past successes and need

to continue to maintain sound economic policy.

Moody’s noted that increasing demands from within the ruling ANC party

and its political partners to step up fiscal easing is problematic given the

roughly 15 percentage point rise that has already occurred in the government's

debt to gdp ratio over the past three years.

With 28% of South Africa’s sovereign bond market held by foreigners, the

country remains very vulnerable to any change in investors’ sentiment about the

sustainability of government finances.

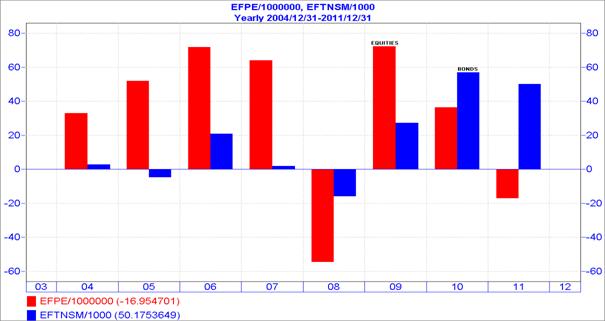

Chart 2 : Foreign inflows into equities and

bonds |

|

|

|

Source: I-Net |

Given

the current uncertainty and heightened volatility, there are three possible

outcomes for the rand.

In

the first scenario, the crisis in the Euro Zone escalates and results in a

larger correction in the rand and asset prices in general. A double-dip recession in Europe, combined

with a full-blown debt crisis could well tip markets over the edge. Policy missteps at home, in an environment of

heightened risk aversion, could also contribute towards a steep depreciation in

the currency.

In

the second scenario, the stop-start growth of the past two years continues and

European policymakers continue to muddle along.

With growth in advanced economies broadly stagnating, investors will be

drawn to the higher yields offered by emerging markets. In this scenario, the rand will retrace its losses

and will settle somewhere below R7 to the dollar over the coming months.

A

combination of both these scenarios is not out of the question either. The currency could well consolidate and

recover in the coming weeks, as investors focus on the good rather than the bad

news in the short term. However, with no

meaningful solution insight for the European debt crisis, the rand could

continue its volatile trend into the New Year.

Conclusion

Much

now depends on how the crisis in Europe unfolds. If some level of confidence is restored,

growth will be slow but steady and the rand would gain as investors looked to

take advantage of the higher yields on offer.

However, if the crisis continues to fester without a real solution, the

rand will remain weak and volatile, with a significant risk the rand collapses

along with other riskier assets.

Table 1 : Influences on the rand |

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Nedbank

Group Economic Unit

Financial

markets analysis: EU peripheral

sovereign debt collapse pushes fund flows to safe-havens

Safe-haven demand for US treasuries buoys dollar

index

Source: I-Net,

Nedbank

l

The US dollar

index measures the dollar against a basket of currencies of major US trading

partners weighted according to value of trade.

l

US treasuries have

maintained their safe-haven status while European sovereign debt woes have

spread from Greece to larger members – Portugal, Spain, Italy and even France.

Their government bond yield spreads against EU benchmark Germany have widened

to levels not seen since euro convergence in the late 1990s (see table page 9).

Greece is closest to default with 3-year sovereign bond yields at an

unaffordable 80%.

l

This scenario has

supported investment demand for the USD, pushing the index above the medium

term declining trend line (June 2010 /August 2011). A sustained move beyond the

recent upside break above the support line across the March/July highs at 76

index points would confirm a likely longer-lasting period of USD relative

strength. This could continue towards the upper resistance line across the

November 2010/January 2011 highs at 81 index points, about 4% above the present

level and similar to the strong bounce in November 2010 from around the same

base level.

l

Renewed volatility

across all financial markets, reducing global investors’ risk appetite,

exacerbating the move to safe-havens as capital preservation becomes asset

managers’ first aim. With a dearth of alternative investment destinations of

similar size, US treasuries have maintained their investment appeal even as

yields fell to record lows, contributing to the dollar index support.

l

Safe haven demand for

US treasuries is supporting foreign capital inflows buoying the USD.

l

The present

determination of the Federal Reserve to maintain or possibly increase US money

supply (M2 +10.1% y/y in September) should support expectations for further USD

depreciation over the longer term after the present rally. This could extend

into 2012 as the length of the average cycle varies between 6 and 14 months,

with the present move having extended for only 2 months.

l

A longer-term weaker

USD, which would be indicated by a turnaround in the dollar index, should

eventually support an export-led US recovery. However, this is not expected within

the near future.

Euro slumps as EU sovereign funding crisis

intensifies

Source: I-Net,

Nedbank

l

Fears of

sovereign debt contagion from the PIIGS group (Portugal, Italy, Ireland,

Greece, Spain) to the banking sector of major EU members, pulled the euro below

the base line of its 5 month consolidating pattern (April/ August) to a daily

closing low of USD1.32/EUR.

l

This is the

first support from which there was a bounce after the early September break

down, as the ECB announced the deployment of short-term liquidity measures to

bolster European banks, whose funding was restricted by reduced access to USD

funding sources.

l

However, the

break below the 2010/2011 rising trend line indicates likely sustained

depreciating pressure remaining on the euro. A further decline below USD1.32/EUR could develop by year-end towards the next lower

support line across the January daily closing low at USD1.29/EUR.

l

EU banks

remain over-exposed to peripheral members’ sovereign debt, as they have to mark

values to market basis which could be as little as 25% of nominal value

resulting in significant write-offs in asset value. This could leave them in

breach of governing regulations on risk and capital requirements, possibly

needing additional capital injections which will be difficult to raise in the current

tight liquidity environment.

l

Their ability

to finance new credit could also be restricted, slowing the region’s economic

recovery potential. This would also have a negative impact on SA’s

international trade pattern and volume as the EU is SA’s most important trading

bloc partner.

l

The worsening

funding and credit status of French banks resulted in Moody’s International

rating agency downgrading European banking giants, Societe Generale, Credit

Agricole and BNP Paribas.

l

The sovereign

debt crisis amongst peripheral members of the European Union (PIIGS group - Portugal,

Italy, Ireland, Greece and Spain) has pushed their government bonds to record

high yields, reflecting their increased credit risk as the Greek 3-year

sovereign bond yield soared to an unsustainable 80% this month.

l

The spreads

between the yields on European peripheral members’ 10-year bonds and German

bunds have widened substantially, remaining at unsustainable levels (see table

below) threatening a debt trap, where debt servicing costs exceed government

revenue, among some members of the PIIGS group. Ratings agencies further downgrading

Greece, Spain, Portugal, Italy and Ireland’s credit ratings as well as

escalating concerns over Italy’s sovereign debt sustainability (government debt

120% of GDP) and political instability, have added to concern over sovereign

debt in the region.

|

|

October 2011 |

November 2011 |

Peak |

|

Greece |

3188

basis points |

3188bp |

3188bp (Nov 2011) |

|

Ireland |

160bp |

639bp |

1193bp (July 2011) |

|

Portugal |

71bp |

974bp |

1065bp (July 2011) |

|

Spain |

64bp |

454bp |

457bp (Nov 2011) |

|

Italy |

96bp |

518bp |

557bp (Nov 2011) |

|

France |

29bp |

185bp |

185bp (Nov 2011) |

l

The historic

correlation between the euro and rand exchange rates against the US dollar, suggests

that a weaker euro would add negative pressure onto the rand exchange rate.

Japanese

yen maintains gains on safe-haven status despite BOJ intervention

Source: I-Net,

Nedbank

l

Forex market intervention

by the Bank of Japan has proved ineffective in stemming the strong appreciating

cycle in the Japanese yen, retaining its 4-year strengthening trend, remaining

around its record strongest level.

l

Short-term

corrections have invariably been met with renewed demand, which appears likely

to continue, as the technical picture indicates a likely continuation of the 3

months pattern of declining highs and lows below the July breakdown.

l

Record low Japanese

interest rates are buoying the carry trade, where funds are moved from low

interest rate currencies like the yen to higher yielding emerging market bonds.

l

This supported demand

for RSA bonds until September 2011 on wide positive interest rate differential,

adding to support for the rand exchange rate and liquidity in domestic

financial markets, while contributing to a lower cost of government funding,

reducing drawdowns on domestic funding sources.

l

However, the recent

turnaround in risk appetite has temporarily interrupted these flows (see page 22),

negatively impacting SA bond yields and the rand exchange rate.

Rand

renews weakening trend against US dollar as global risk appetite reverses

Source: I-Net,

Nedbank

l

The reversal of

global risk appetite, leading to a withdrawal of international investor funds

from equities into safe haven US treasuries and gold, has intensified depreciating

pressure on the rand.

l

The rand has made a

significant break away from its long-term appreciating cycle (2008/2010),

followed by its medium-term base consolidating formation (2011) and a steep

depreciating spike to a weakest R8.45/USD before returning to the current test

of the pivotal level around R7.80/USD to R7.90/USD.

l

However, recent

upheavals in the euro have rippled through to higher risk EM currencies,

pushing the ZAR above the upper trend line of the 2-month

declining/strengthening range.

l

The surge above the

recent breakout level at R8.00/USD could introduce a new weaker range,

initially extending to the September weakest level at R8.40/USD, with potential

to move towards the next rand support level at R8.60/USD.

l

Sustained global

currency uncertainty, possibly sparked by changes in membership of the European

Union, could spark an intensification of risk aversion, pushing the rand

towards the weakest rand support level around R9.30/USD over the medium-term.

l

Renewed speculation

on a double-dip recession in the Euro Zone and UK has diminished expectations

for robust growth in commodity based emerging markets.

l

This has raised fears

of declining SA exports, rippling through to a negative impact on the trade and

current account deficits, leading to further rand depreciation over the

medium-term.

l

This will have a

serious impact on pushing up producer and consumer inflation. SARB Governor

Marcus recently warned that rand depreciation would be the biggest inflation

threat facing SA.

Rand weakens against euro, despite EU funding

challenges

Source: I-Net,

Nedbank

l

The rand reversed its

long term appreciating trend (2008/2010) against the euro in January 2011,

breaking above the declining trend line of its 27 month cycle before

consolidating in a narrow range between R9.50/EUR and R10.00/EUR.

l

A surge in risk

aversion led to a sell-off in emerging market currencies against global reserve

currencies, pushing the rand above the February/July consolidating pattern.

This was followed by a higher/weaker trading range, with the previous ceiling

at R10.00/EUR reverting to a floor for a new weaker trading range, which

extended to R11.35/EUR where a rally soon corrected its temporarily oversold

status.

l

A new range is

developing, remaining above the short-term interim rising trend line

(September/ November) with the short-term pattern indicating potential for

further losses towards the next higher support line around R11.77/EUR.

l

The current EU

sovereign debt and bank funding crises have held the euro in a weaker trading

range below the more buoyant levels seen in 2011/H1. However, the reversal in

global investor risk appetite has held the rand around its weakest levels

(September/ November) since late 2009.

l

This could have a

significant impact on SA foreign trade as the Euro Zone is SA’s major

international trading bloc partner, risking higher imported input costs on

producer and consumer inflation, which would be partially offset on the trade

account with higher export earnings in rand terms.

Rand maintains weaker range against British pound

Source: I-Net,

Nedbank

l

Since the rand broke

above the ceiling of the previous trading range at R11.90/GBP, this level has

reverted to a floor for a new weaker range, which could extend towards the

upper support line across the June/August 2009 weakest levels at R13.50/GBP.

l

The UK economy has failed

to rebound strongly from the 2008/09 recession, extending fragile economic

activity and low confidence outlook into 2011/2012, while economic growth

prospects remain weak on a deteriorating global economic outlook and aggressive

UK government budget austerity measures, likely delaying monetary policy

tightening, limiting gains in the British pound, slowing the weakening GBP/ZAR

trend.

l

A temporary support

ceiling has formed around R12.90/GBP, which is currently being challenged

(September/ November). A break above this level would support expectations for

the weaker trend to extend towards R13.50/GBP.

Rand weakness

against Japanese yen threatens higher SA producer input costs, rippling through

to higher consumer inflation

Source: I-Net,

Nedbank

l

The rand has made a

decisive break below the 2009/2011 consolidating pattern between JPY11.0/ZAR

and JPY13.0/ZAR, with the minor recovery in August and subsequent fall being a classic

“goodbye kiss”, supporting the establishment of a weaker range between

JPY9.0/ZAR and JPY11.0/ZAR.

l

Low Japanese interest

rates facilitated the attraction of carry trade investments into higher

yielding emerging market assets, benefiting foreign portfolio inflows into RSA

bonds, inflating domestic liquidity, supporting the rand. However, a subsequent

decline in risk appetite sparked a reversal of investment funds from the rand

arena and a turnaround in recent declining bond yields, risking an increase in the

cost of government funding.

l

Relative rand

stability anchored the cost of imported Japanese goods between April 2009 and

July 2011, having a stabilising impact on SA’s motor industry, improving that

sector’s export prospects, after imports of vehicle manufacturing inputs

suffered massive price distortions in 2006/2008 when the rand plunged from JPY

19.60/ZAR to JPY 8.40/ZAR within a 2½ year period, placing huge pressure on

imported input prices and manufacturers’ profit margins. Recent currency

movements risk another adverse change to this relationship.

l

This will buoy

producer inflation, rippling through to higher consumer prices over the

medium-to longer-term. In this scenario the SARB is unlikely to cut interest

rates again in the current cycle despite the fragile domestic and global

economies.

l

The yen is taken as a

proxy for the currencies of China and South-East Asia, although SA’s imports

from the region are dollar-denominated. China has grown to be SA’s largest

single country trading partner, emphasising its growing importance to the

African continent, as it strives to obtain long-term base commodity resources

to satisfy its voracious resource appetite to sustain its aim to maintain an

8-10% annual GDP growth rate, while transforming from an agrarian led economy

to a modern industrialised consumer driven society. Chinese monetary policy has

been tightened over the past year, as the Authorities struggled to rein in

rampant speculative activity in equities and property and to control rising

inflation from excessive credit creation.

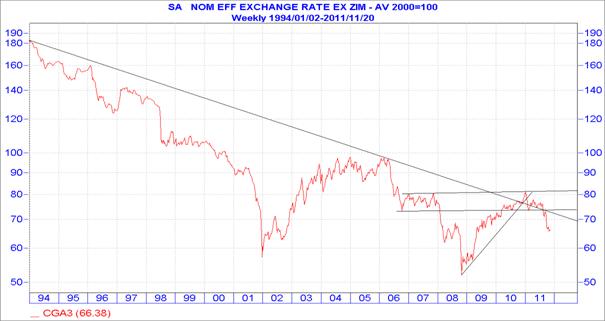

Rand nominal effective exchange rate (NEER) plunges below long-term

support levels

Source: I-Net,

Nedbank

l

The NEER measures the

rand against a basket of currencies of SA’s major trading partners weighted

according to value of trade.

l

The index has

reversed its recovering trend (2009/2011) plunging below the long-term

declining trend line (1994/2011), while also falling below the consolidating

pattern established in 2007 and 2010/2011 between 73 and 81 index points.

l

The sustained move

below these levels supports expectations for medium-to longer-term rand

weakness.

l

This will buoy SA

export earnings in rand terms, but reinforce higher imported producer input

prices, rippling through to higher consumer inflation, negatively impacting

SA’s competitiveness over the longer-term, slowing economic growth and job

creation.

Gold renews long-term

rising cycle

Source: I-Net,

Nedbank

l

Heightened concerns

over the spreading European sovereign debt crisis, worries over a double-dip EU

recession, while the US lost its AAA credit rating and indications the economic

recovery in developed economies may be stalling, increased investor anxiety and

pushed the gold price to an intra-day record high at $1921/oz in September on

demand for the “ultimate” currency hedge.

l

While the

long-term rising cycle (2009/2011) remains intact, the current pullback from

the double-top reversal pattern (August/September) and decline below the steep short-term

rising trend line (July/September), indicates the development of some

consolidation within the top trading range between $1600/oz and $1900/oz.

l

The rand gold price hit

a fresh peak at R14684/oz on 21 September, buoying export earnings, supporting

the trade and current accounts, while contributing to some support for the rand

exchange rate, however,

these gains have been partially offset by the miners’ strike, safety related

stoppages and operational setbacks.

l

Currency

volatility and escalating uncertainty over central bank interventions should

maintain demand for gold as the ultimate currency and inflation hedge. This

could extend the lives of SA’s low grade, high cost gold mines, reinvigorating

a “sunset industry”, buoying SA export earnings, slowing the trade and current

account deficits and the rand’s weakening tendency.

Rand weakness

supports gold industry earnings

Source: I-Net

l

Despite strong rand

appreciation against the USD over the past 4 years, the gold price in rand

terms has performed similarly to the gold price measured in dollars, while the

recent rand pullback has provided a further boost to producers’ revenue

streams.

l

The 2011 reversal of

the rand’s 2-year appreciating trend has added further to miners’ revenue

gains, benefiting the trade and current accounts, possibly slowing the rand’s

weakening tendency.

l

However, renewed rand

relative strength would offset the gains from the higher bullion price which

the industry desperately needs as it reels under the increasing challenge of

high costs, diminishing ore grades, scarcity of suitably qualified miners and

strike action to support demands for ever increasing wages, with no counter-balance

in labour productivity, reducing profitability and the industry’s contribution

to the fiscus (tax take).

l

These factors have

exacerbated the challenge of mining at ever-deepening depths forcing mining

companies to consider automated mining techniques, limiting job creation and

poverty alleviation, with the existing base employee group supporting on

average between 5 to 10 direct and extended family dependants.

l

This will force

government to extend social grants to a wider group, absorbing a greater share

of government’s revenue, slowing capital allocations to infrastructure

development while deferring a robust investment-led broad economic recovery.

Oil price stabilises in

lower range as EU economic prospects stagnate

Source: I-Net,

Nedbank

l

Since the Libyan

political dispute concluded, expectations for renewed oil supplies have risen

(estimated 2012 production +1mn barrels per day), while the economic outlook

deteriorates reducing oil demand estimates, the spot price of Brent crude oil

has settled in a narrow range between $101/barrel and $115/b.

l

OPEC are considering

cutting production, reducing supplies to the market despite the onset of

Northern hemisphere winter accompanied by high demand for heating oil, after

the US summer time driving season saw the lowest gasoline demand in 8 years.

l

The break below the

lower trend line of the primary rising cycle (2009/2011) indicates a possible

directional change, while temporary support is provided by the horizontal

support line across the August/October lows at $101/b.

l

A continuation of the

current sideways pattern is expected to continue in the short-term, with

possible downside risk if the current EU debt crisis leads to a wider economic

slowdown, negatively impacting fuel demand.

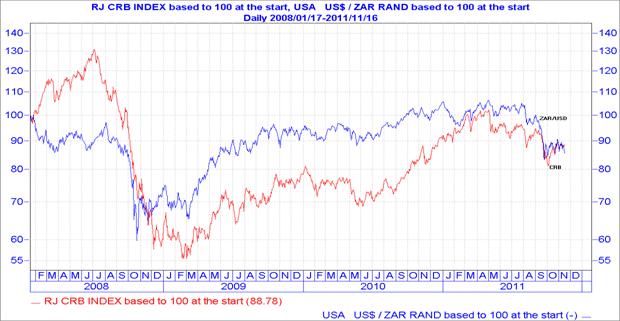

Commodity price cycle leads

rand exchange rate

Source: I-Net

l

Base commodity prices

lead the SA economic cycle, as SA remains a major producer of precious metals

(platinum and gold) and industrial commodities (coal, iron ore), resulting in a

fair correlation between commodity prices and the rand exchange rate.

l

Expectations for a

further decline in industrial commodity prices as the developed world economies

renew their slide towards a potential double-dip recession, reversing previous

strong demand estimates, support expectations for a gradual weakening in the

dollar/rand exchange rate over the medium-to longer-term.

Rand depreciation reverses, benefit from weaker oil price on SA

Source: I-Net

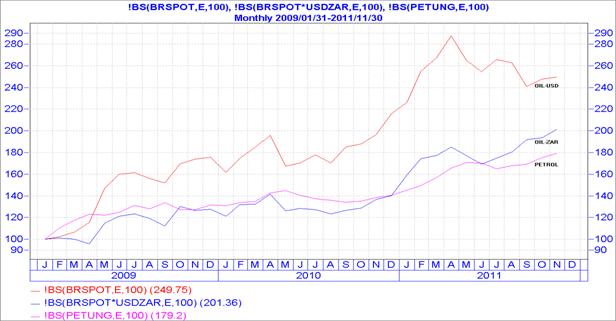

l

Oil, SA’s major

import, is priced in dollars, making domestic fuel costs susceptible to the

dollar/rand exchange rate.

l

Volatility in the oil

price and the dollar/rand exchange rate have led to swings in the imported cost

of oil and significant fluctuations in domestic fuel prices, having a

considerable impact on producer and consumer inflation.

l

SA domestic fuel

prices benefited from rand appreciation between January 2009 (R9.50/USD) and April

2011 (R6.55/USD), slowing the impact of the higher oil price. The dollar oil

price is up 149.8% since January 2009 while the rand oil price has risen

101.4%, slowing the petrol price increase to 79.2%.

l

The benefit from the

rand’s strengthening bias against the USD over this period has partially

protected SA from much higher domestic fuel prices. However, the current weaker

trend in the rand is minimising the previous benefit, raising the risk of

higher producer and consumer inflation.

l

This supports the

view that SA cannot afford a weak currency as domestic inflation accelerates on

the back of rand depreciation, a risk currently developing as global risk

aversion reverses the rand’s previous appreciating/ consolidating trends.

l

Despite increased

rand earnings on more competitively priced exports arising from a weaker

currency, the higher cost of new fixed investment and rising imported input

prices would quickly offset the temporary gains in export earnings. This could

place SA on a treacherous path of further rand depreciation, declining economic

activity and job losses, undoing the benefits hard won over the past 17 years

through responsible fiscal and monetary policies.

Nedbank fuel hedging

product

l

To protect heavy fuel

consumers against unexpected fuel price volatility, Nedbank has a unique hedging

product stabilising the rand cost of fuel, which can be accessed through

Nedbank Global Markets Business Banking (+2711 535 4003) and Corporate Sales

Desk (+2711 535 4002).

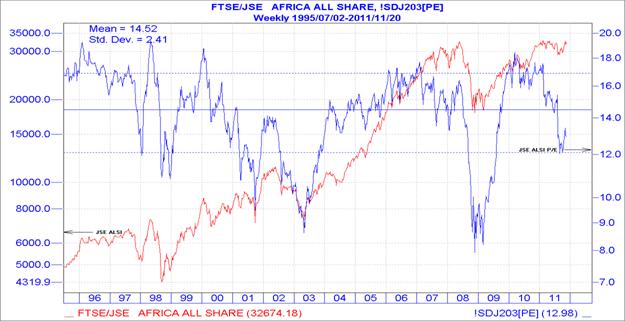

JSE

All Share Index (ALSI) tracks international equity markets lower on faltering

risk appetite and weakening economic prospects

Source: I-Net

l

The JSE ALSI hit an

intra-day record high at 33334.55 on 14 February 2011 led by resource stocks

amid rising commodity prices, with supply constraints and rising demand pushing

up prices.

l

Subsequently the JSE

ALSI pulled back with cautious investors succumbing to profit-taking as the

previous record high in 2008 was set in an environment of domestic economic growth expectations of 5%-6%,

while forecasts for 2011 GDP growth are more moderate at around 3%. In

addition, risk aversion has increased on heightened uncertainty about local and

global economic recovery prospects and jitters over the unresolved EU sovereign

debt and bank recapitalisation crises, while the reversal in precious metals

and industrial commodity prices has intensified gloomier corporate profit

expectations.

l

This has

pushed the average P/E ratio from 17.50 in February to the present 12.98 (on

historic earnings), close to the lowest since July 2009, moving below the long-term

mean of 14.52 on declining expectations for growth in corporate profits in a

slowing economic environment.

l

This analysis

suggests a cautious approach towards the allocation of additional investment

funds to equities, possibly slowing foreign capital inflows to the JSE and their

benefit to the rand exchange rate (see analysis page 22).

Foreign portfolio inflows to SA bonds

offset outflows from SA equities

Source: I-Net

l

Net foreign trades in

equities are shown in the red bars while foreign bond trades are shown in the

blue bars.

l

There was some

bargain hunting by foreign investors in equities on the JSE and for RSA bonds

in the first week of October, but these were not significant quantities.

l

Declining foreign

portfolio inflows could increase pressure on National Treasury to fund the

current account deficit through increased offers at their weekly bond auctions.

l

This could add to

upside pressure on RSA bond yields in the short-to medium-term.

Currency

calendar: Rand posts widespread

depreciation as risk appetite reverses

The graph

below shows the appreciation or depreciation of the rand daily closing exchange

rate on a percentage basis over the past month (between 14 October and 15

November) and in the year-to-date (ytd) (3 January to 15 November) against

major currencies, with depreciation shown below the 0% line and appreciation

above. Over the past month the rand posted a widespread depreciation against

major currencies, led by losses against the Japanese yen (-4.61%), the British

pound (-4.35%) and US dollar (-4.34%) as investor risk appetite was dented on

worries over the worsening EU sovereign debt crisis and deteriorating global

economic prospects, limiting demand for higher yielding currencies. This

exacerbated the rand’s ytd losses, pushing the local unit down 25% to 30%

against major currencies, led by losses against the safe-haven yen (-32.1%),

British pound (-26.44%) and the US dollar (-2.42%).

Source: Bloomberg

The graph

below summaries the dollar’s appreciation or depreciation against other major

currencies over the past month (between 14 October and 15 November) and in 2011

ytd. Over the past month the dollar mostly appreciated against major

currencies, supported by safe-haven inflows into US treasuries as global risk

appetite remained volatile amid concern over the unresolved European sovereign

debt crisis and the risk of contagion rippling through the global economy and

the systemic risk it poses on the world financial system. Gains were led

against the rand (+4.16%) and the Swiss franc (+2.57%), but limited against the

yen (-0.25%) as risk appetite improved on hopes that policymakers would take

bold steps to tackle the debt crisis. In the ytd the dollar extended its

appreciation trend against most major currencies, led by gains against the rand

(+19.62%) and Swiss franc (+1.68%). However, the dollar lost ground against the

Japanese yen in the ytd (-6.16%) following intervention in the foreign exchange

market by the Bank of Japan at the end of October.

Source: Bloomberg

The graph

below summaries the appreciation or depreciation of emerging market currencies

against the US dollar over the past month (since 14 October) and in the 2011

year-to-date. In the past month and in the ytd emerging market currencies extended

their depreciating trend against the dollar, as the deepening European

sovereign debt crisis maintained choppy risk appetite, prompting investors to

shift out of emerging markets and move into the safe-haven of US treasuries. The

Hungarian forint (-9.7%) and the Czech koruna (-6.13%) were the worst

performers on a monthly basis, while the rand (-19.1%) and the Turkish lira

(-13.6%) were the hardest hit in the year-to-date, despite attempts by the

Turkish Central Bank to strengthen its currency.

Source: I-Net

Ian Cruickshanks

Nedbank Treasury Strategic Research

Economic data releases and MPC meeting

dates

Economic data releases

|

Date |

Time |

Indicator |

Period |

Previous |

|

22

November |

09:00 |

SA leading

indicator |

September |

130.7 |

|

23

November |

10:00 |

CPI (m/m) |

October |

0.4% |

|

23

November |

10:00 |

CPI (y/y) |

October |

5.7% |

|

24

November |

11:30 |

PPI (m/m) |

October |

-3.3% |

|

24

November |

11:30 |

PPI (y/y) |

October |

10.5% |

|

29

November |

08:00 |

Private Sector Credit

(y/y) |

October |

5.47% |

|

29

November |

08:00 |

M3 Money Supply

(y/y) |

October |

6.80% |

|

30 November |

11:30 |

SA GDP (q/q) |

Q3 |

1.3% |

|

30

November |

14:00 |

South Africa

Budget |

October |

-R17.01B |

|

30

November |

14:00 |

Trade Balance |

September |

-R2.5B |

|

30

November |

11:00 |

Kagiso PMI |

November |

50.5 |

|

01 December |

08:00 |

Net Reserves |

November |

$49.22B |

|

01 December |

08:00 |

Gross Reserves |

November |

$59.35B |

|

07 December |

11:00 |

Vehicle sales |

November |

18.9% |

|

12

December |

13:00 |

SACCI business

confidence |

November |

97.5 |

Source:

Bloomberg

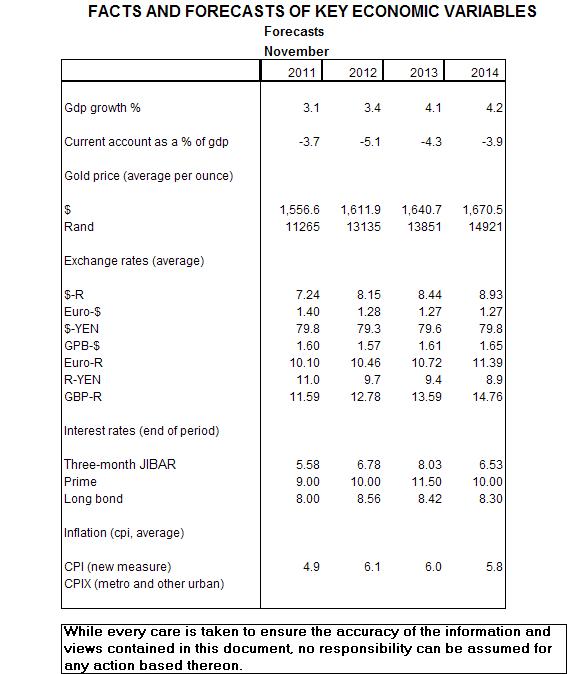

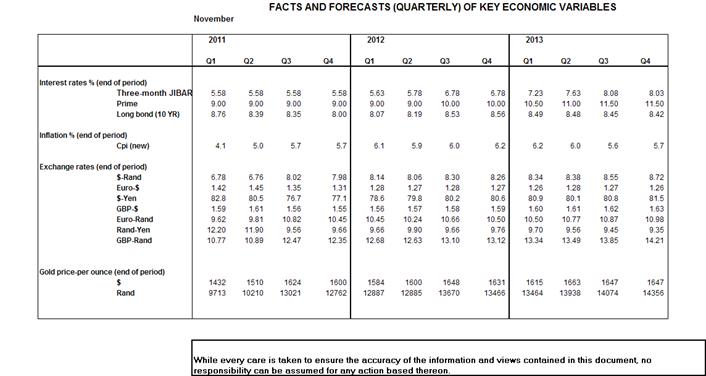

Nedbank Economic

facts and forecasts

Source:

Nedbank Group Economics Unit

Source:

Nedbank Group Economics Unit

Reports

produced by Nedbank Treasury Strategic Research

Daily market and economic comment

Monthly currency insights

Monthly interest rate insights

To receive any of these publications

or to request alternative financial market data and analysis, please contact:

Ian Cruickshanks (+27 11) 295-8640 iancr@nedbankcapital.co.za

Michelle Pingo-de

Abreu (+27 11) 294-1753 michellep@nedbankcapital.co.za

Tasnim Rawat (+27

11) 294-3744 tasnimr@nedbankcapital.co.za